Mutuari - Trustworthy Crypto Lending Made Clear

Mutuari - Trustworthy Crypto Lending Made Clear

Web3 & Crypto

4 min read

2024

Overview

Overview

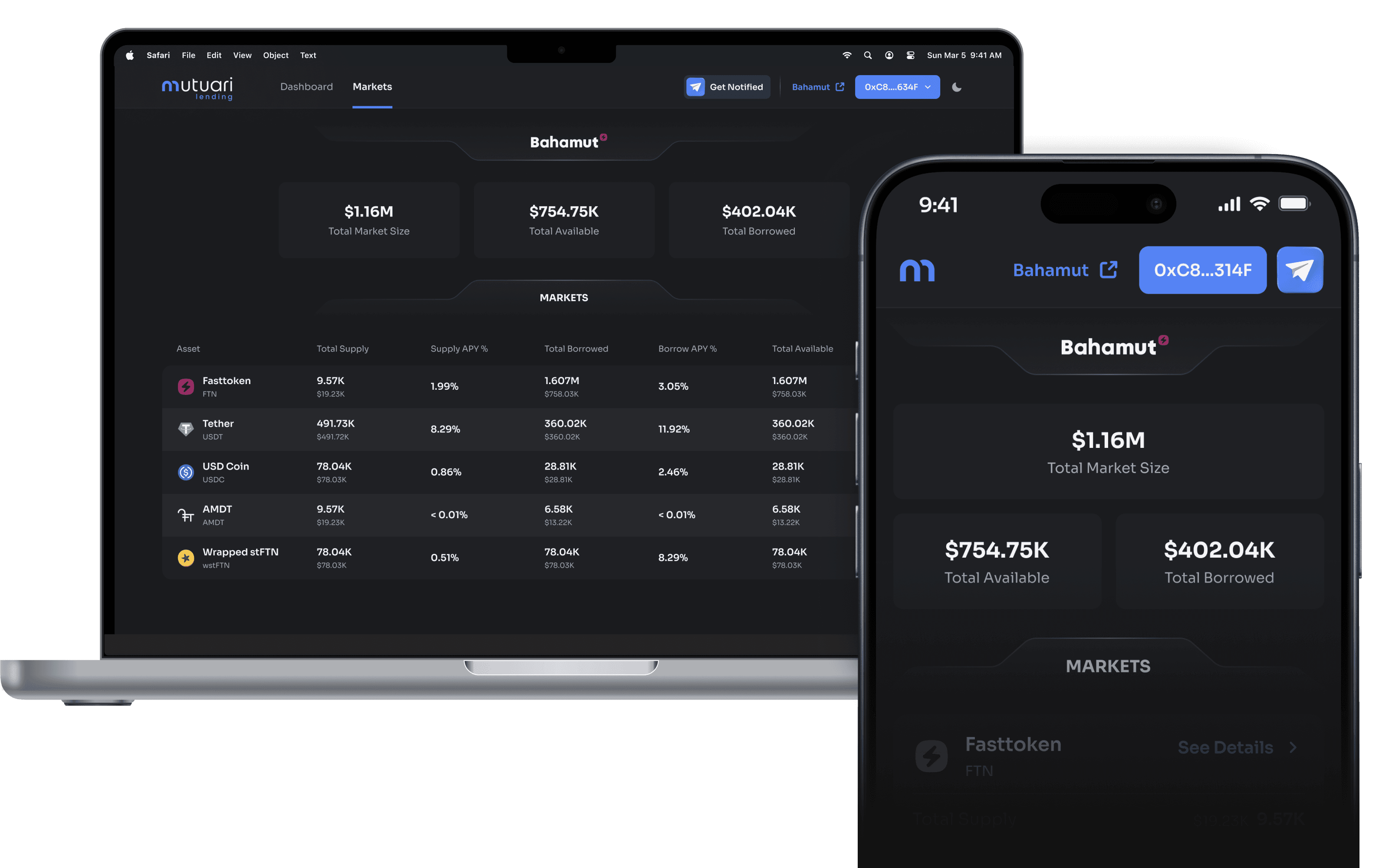

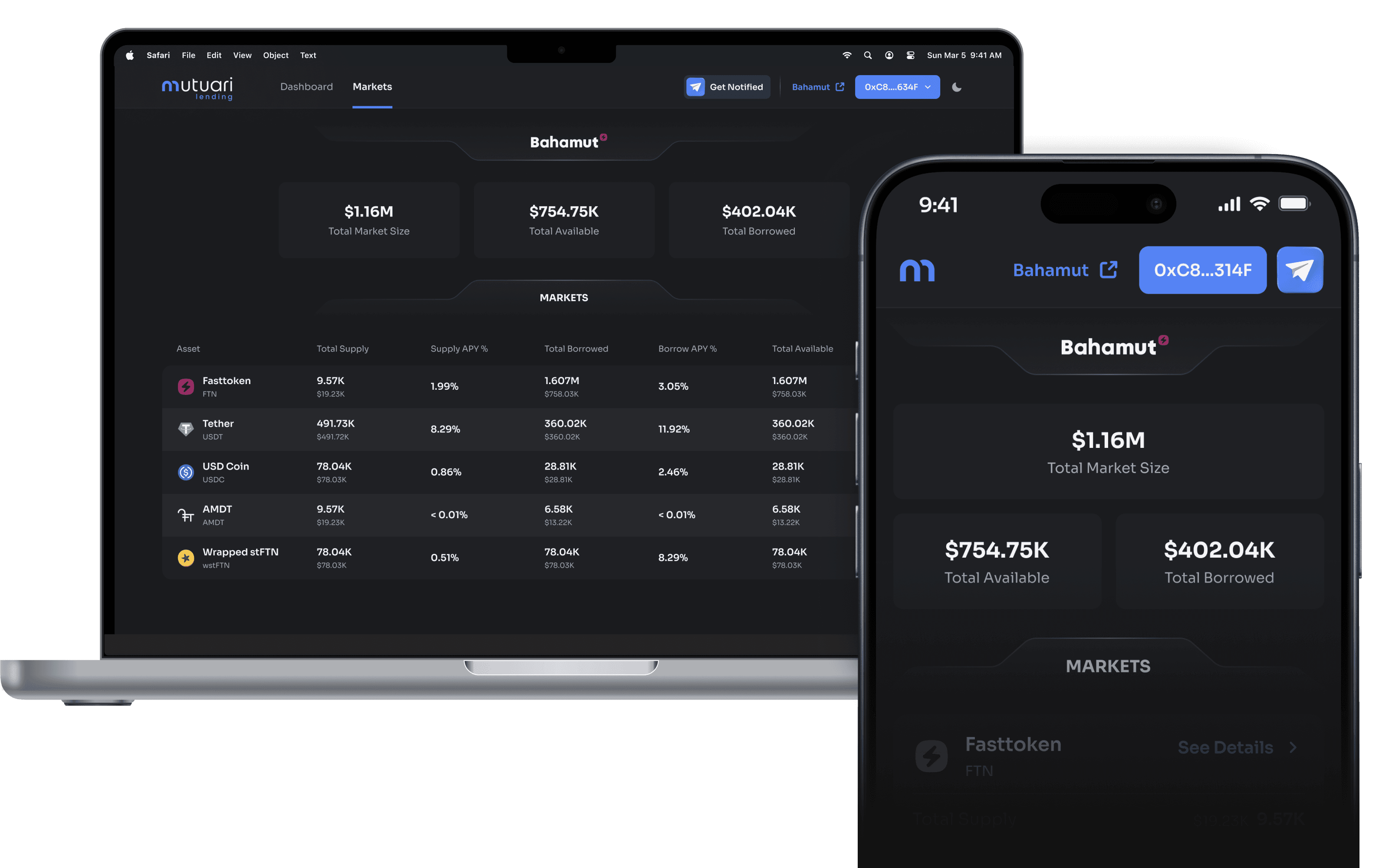

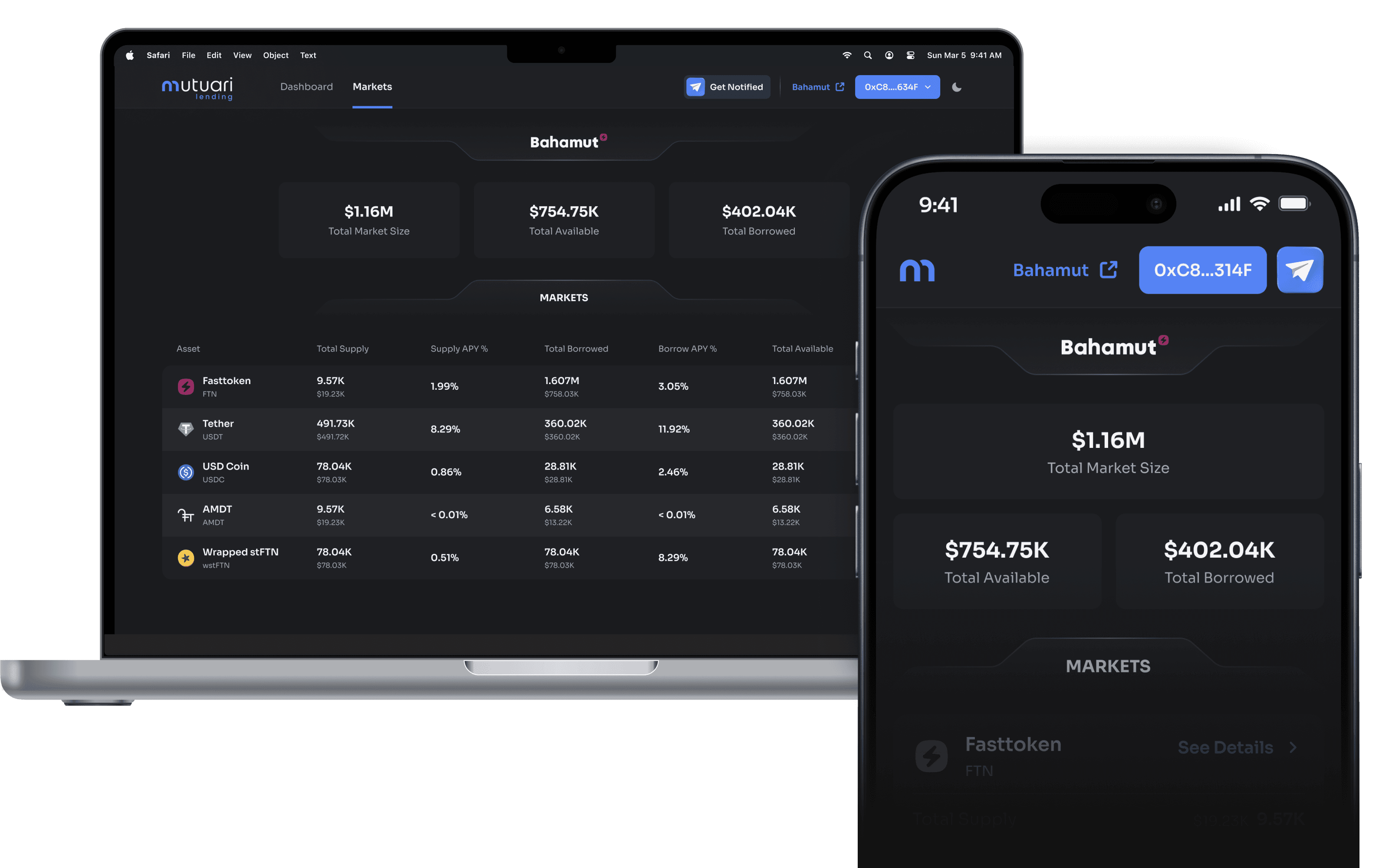

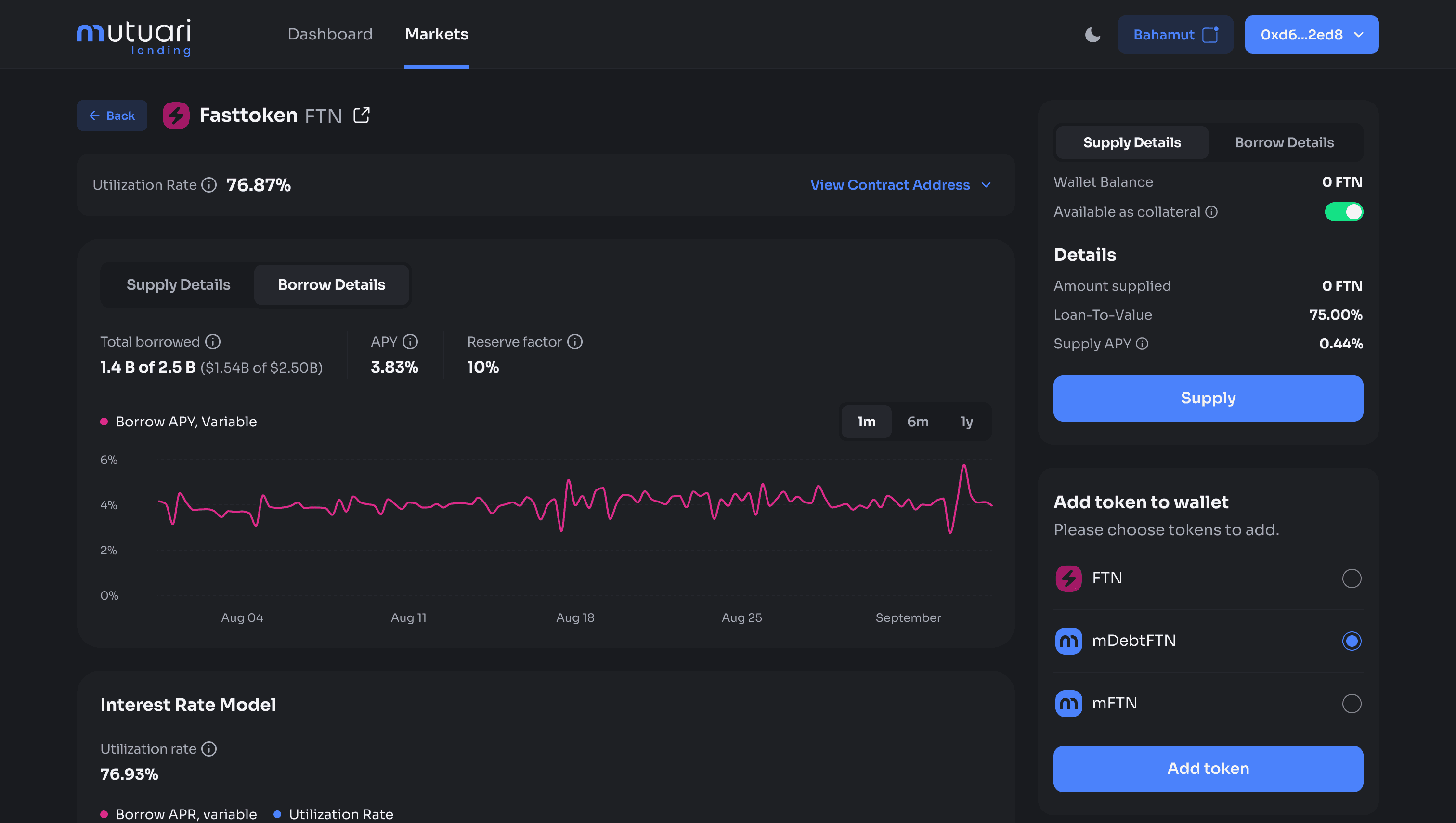

Mutuari is a peer-to-peer crypto lending platform. I designed it to feel trustworthy and transparent — even for users unfamiliar with DeFi. From listing loans to tracking repayment, every interaction builds confidence without hiding complexity.

Mutuari is a peer-to-peer crypto lending platform. I designed it to feel trustworthy and transparent — even for users unfamiliar with DeFi. From listing loans to tracking repayment, every interaction builds confidence without hiding complexity.

My Role

My Role

As a Senior Product Designer, I:

As a Senior Product Designer, I:

• Designed borrower and lender flows from scratch

• Designed borrower and lender flows from scratch

• Created visual logic for risk, loan states, and repayments

• Created visual logic for risk, loan states, and repayments

• Introduced semantic color tokens to maintain clarity and accessibility across views

• Introduced semantic color tokens to maintain clarity and accessibility across views

The Challenge

The Challenge

Crypto lending is powerful — but often overwhelming. The main issues:

Crypto lending is powerful — but often overwhelming. The main issues:

• Jargon-heavy interfaces

• Jargon-heavy interfaces

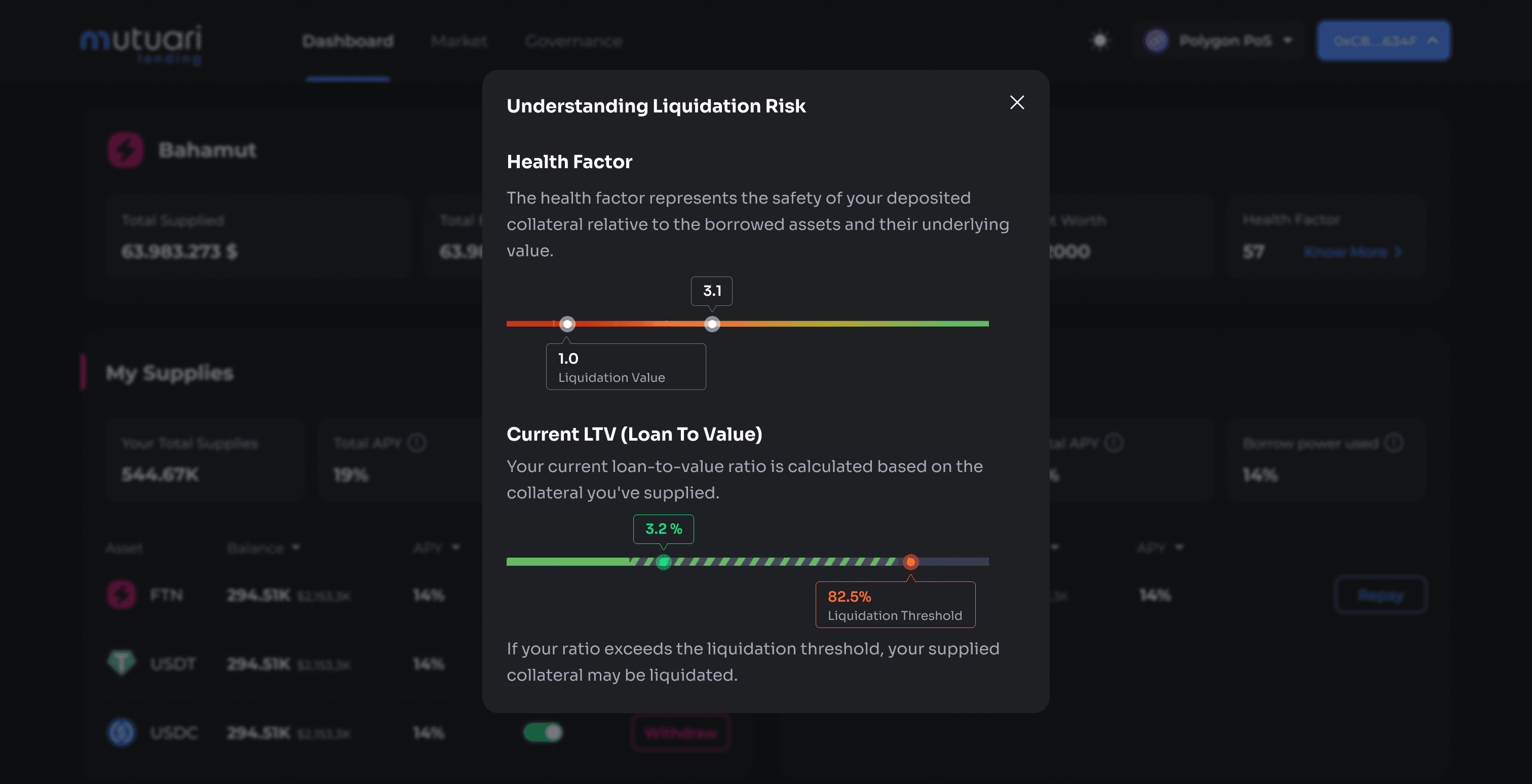

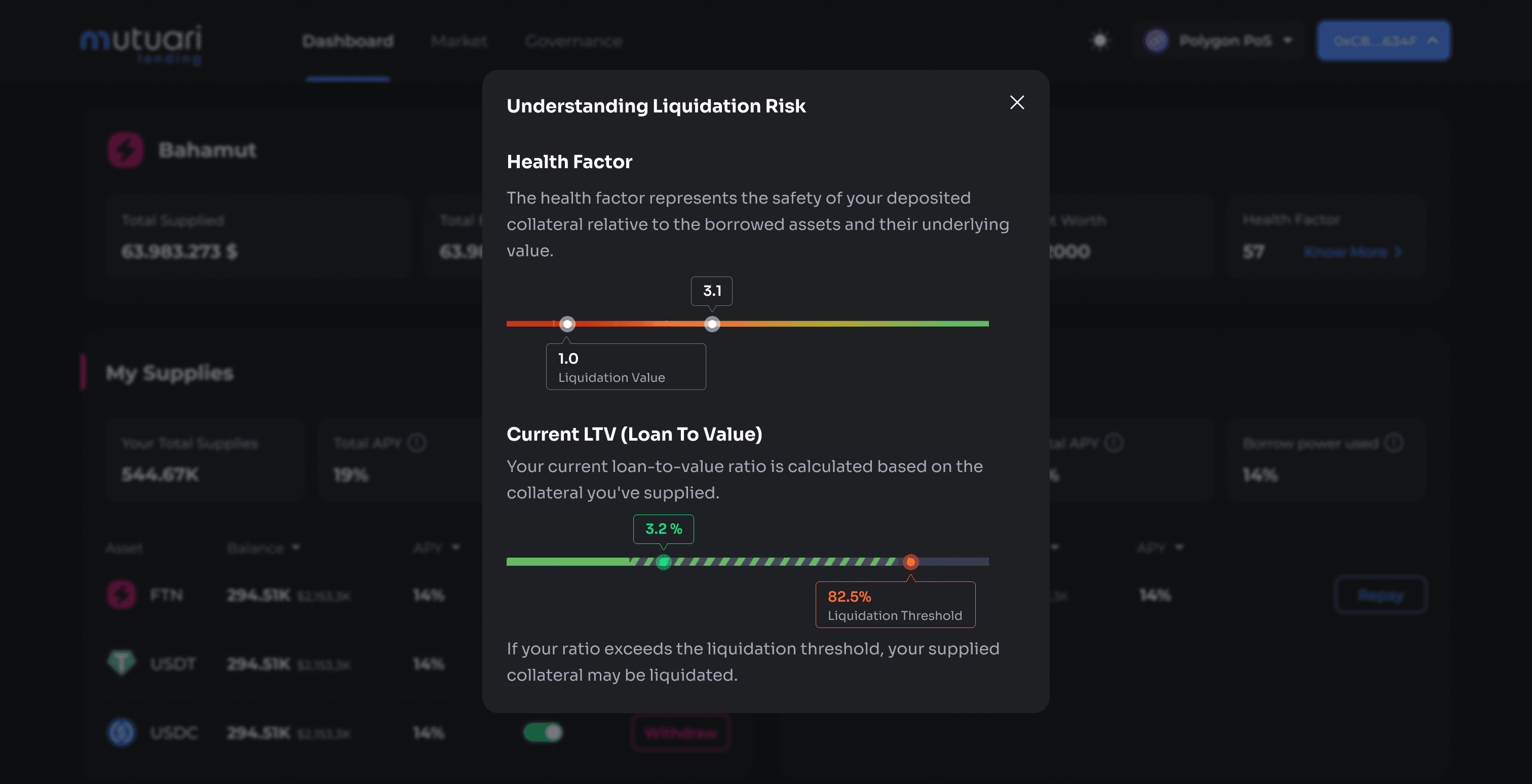

• Unclear collateral and loan risk

• Unclear collateral and loan risk

• Lack of visual hierarchy and trust signals

• Lack of visual hierarchy and trust signals

We interviewed users who said the biggest blocker was fear of losing funds due to unclear processes.

We interviewed users who said the biggest blocker was fear of losing funds due to unclear processes.

What I Did

What I Did

1. Simplified Flows

1. Simplified Flows

Users can:

Users can:

• Create a loan request by choosing asset, APR, and duration

• Create a loan request by choosing asset, APR, and duration

• Track active loans and view repayment timelines

• Track active loans and view repayment timelines

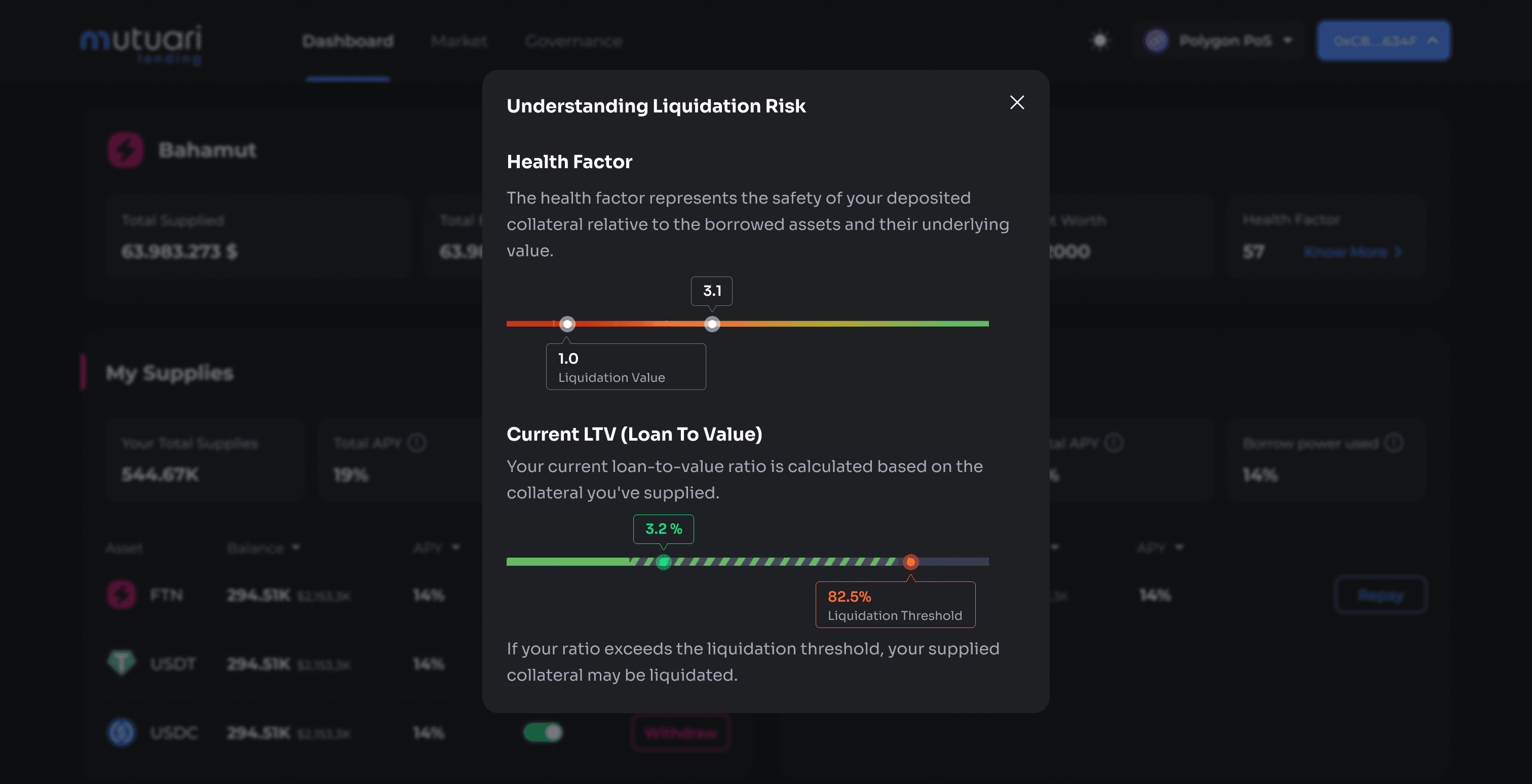

• Monitor collateral health in real time

• Monitor collateral health in real time

2. Trust Through Interface

2. Trust Through Interface

We built Loya as a layered system:

We built Loya as a layered system:

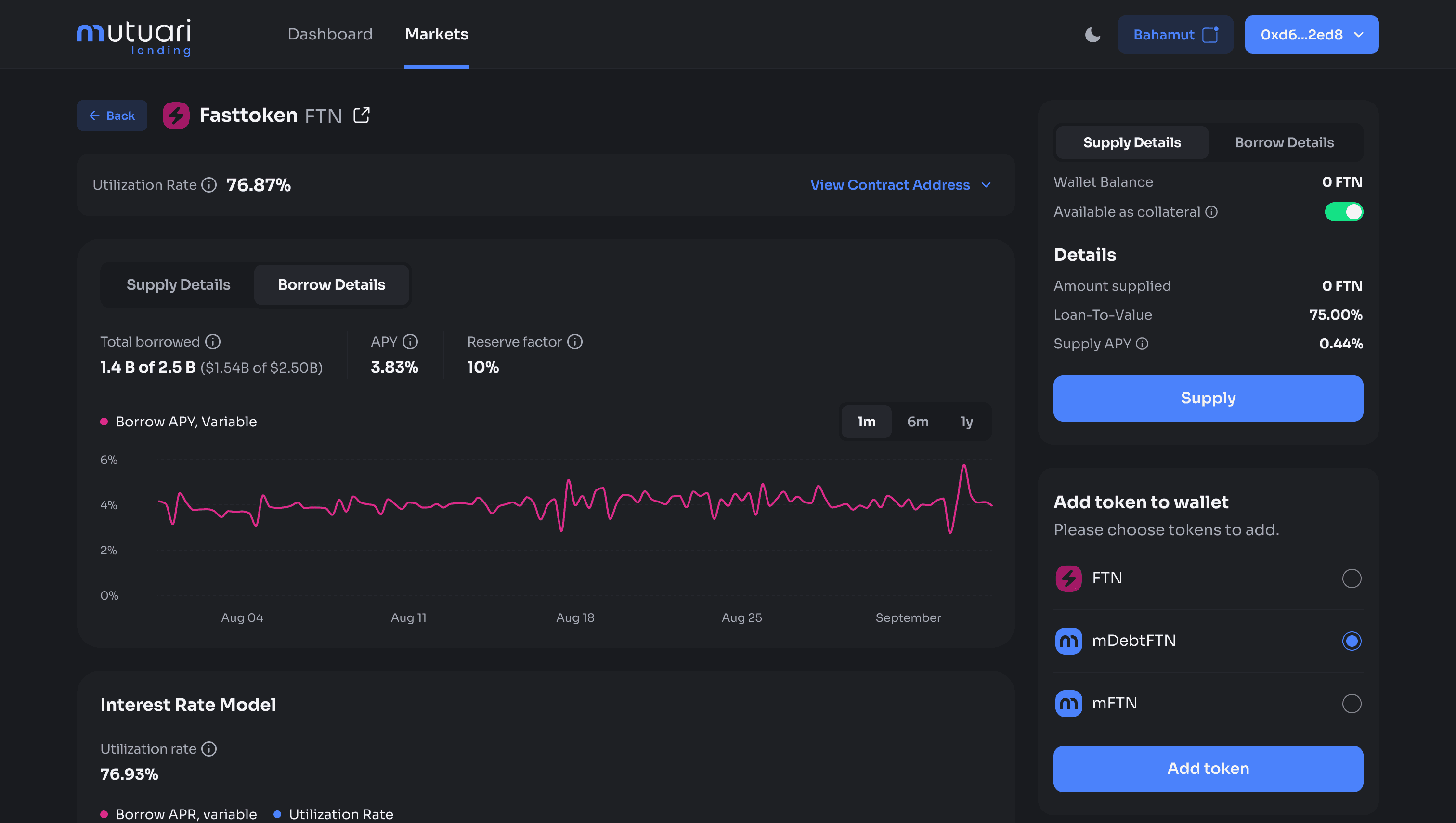

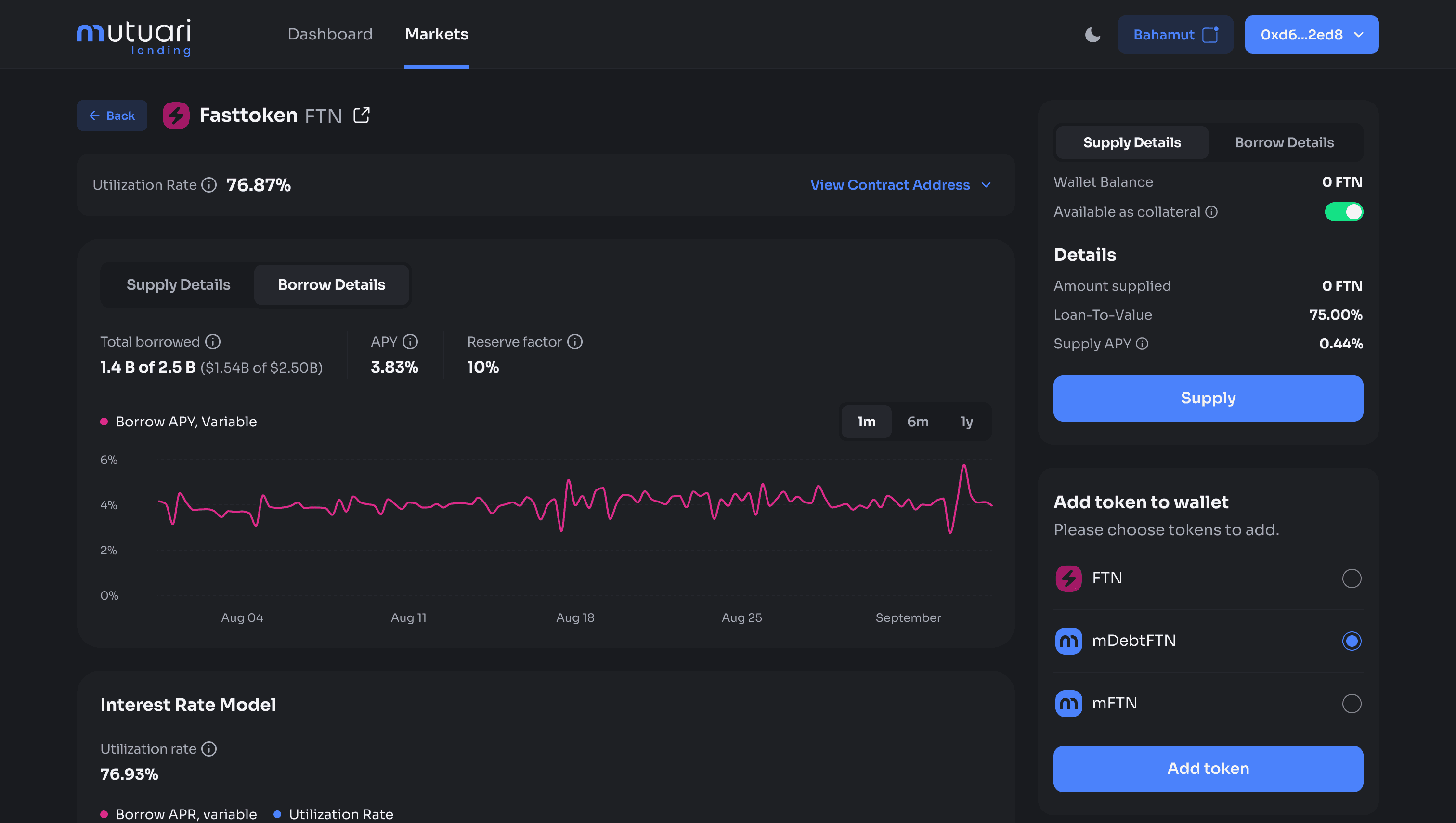

• Used plain-language labels and APR breakdowns

• Used plain-language labels and APR breakdowns

• Designed visual loan cards with key info up front

• Designed visual loan cards with key info up front

• Built responsive layouts that adapt to loan status

• Built responsive layouts that adapt to loan status

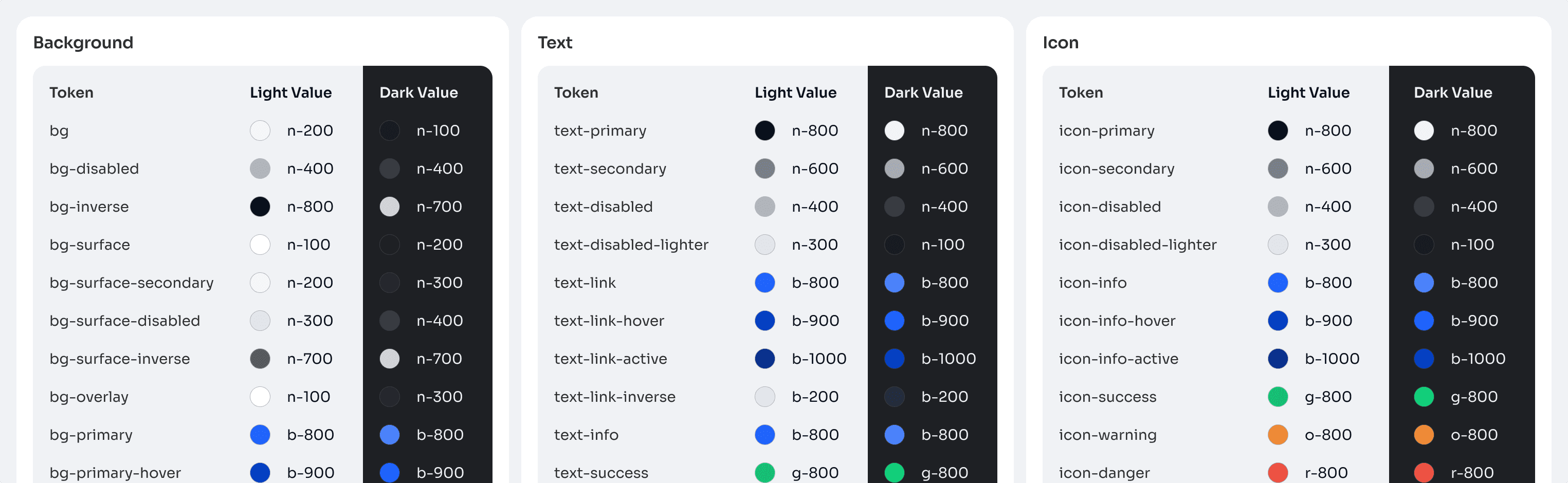

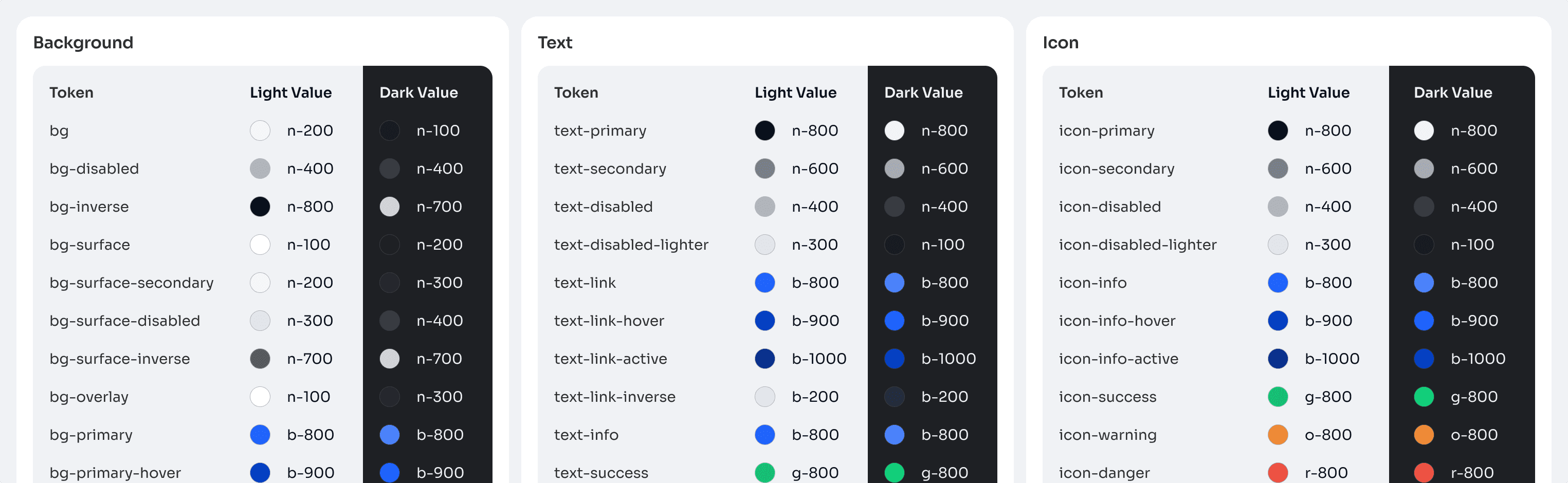

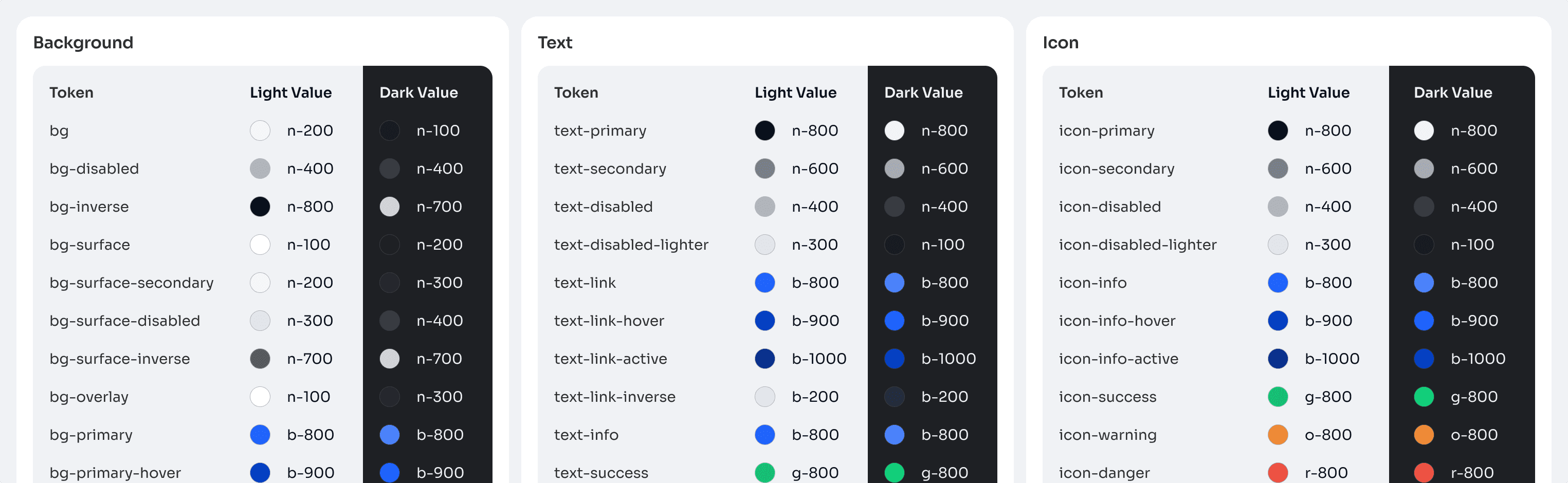

3. Semantic Color Tokens

3. Semantic Color Tokens

To show loan and collateral status clearly:

To show loan and collateral status clearly:

• Used tokens like success, warning, and danger

• Used tokens like success, warning, and danger

• Applied them to components like loan progress and collateral indicators

• Applied them to components like loan progress and collateral indicators

• Ensured consistent UX and better developer handoff

• Ensured consistent UX and better developer handoff

Outcome

Outcome

• +50% more users completed loan requests (vs. prototype)

• +50% more users completed loan requests (vs. prototype)

• Strong feedback around trust and transparency

• Strong feedback around trust and transparency

• Fully launch-ready design

• Fully launch-ready design

DeFi doesn't need to be complex to feel powerful. Clear visuals, familiar patterns, and intentional color use go a long way in building user confidence.

DeFi doesn't need to be complex to feel powerful. Clear visuals, familiar patterns, and intentional color use go a long way in building user confidence.

Let’s Talk

Let’s Talk

Want to simplify your Web3 product?

Want to simplify your Web3 product?

Designs That Drive Real Impact

Designs That Drive Real Impact

Designs That Drive Real Impact

End-to-End Strategic Product Design

End-to-End Strategic Product Design

End-to-End Strategic Product Design